Contents:

It should apply Geocentric system, that is the Earth is in the center, at Angle of 180 degrees and move Clockwise. It is also important to select in the Location section the City, the time zone of which is used for the forecast . I started describing Gann’s trading methods with this topic because its a link between maths and astrology. Today, we’ll get closer to the stars and study Gann’s works, devoted to astrology. Gann himself wrote many times that one needs to apply astrological calculations, in addition to mathematical ones, in order to receive profits instead of losses from trading. No traders had matched Gann’s remarkable predictions and trading record.

The Simple Way to Read Volatile Markets… And See What’s Next … – DailyWealth

The Simple Way to Read Volatile Markets… And See What’s Next ….

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

Trineaspect.com and Khit Wong are not responsible for any profit or loss on actions taken on the comments shared in FXStreet.com. While the comments do not suggest nor imply in any way for any trade decisions for the readers, they are all for educational purposes. When you see a giant candle, it indicates a lot of energy is trapped but has no avenue to release. The market had to release all the remaining power in 20 minutes to match its time target of September 30th, 4 pm. Gann had figured out the end of the cycle time, September 30th, 1909, well in advance.

The green circles show the moments when profits should be taken on the trade. Up-trending support angles show support, whereas down-trending angles are a sign of resistance. Traders may also use different angles to identify resistance or support.

Trend Deciding Level:2222

When this happens, the price bounces downwards, creating a new short opportunity. This is a new reversal and we use the top of the reversal for our stop loss order. The trade is held until the price breaks the same level it has bounced from.

He was very interested in this, and at age 25 he left for New York and got a job at a large brokerage company on gann trading strategy. Towards the end of his life, William Gunn earned over $ 50 million. The picture illustrates four trades based on signals from the Gann Grid indicator. The black horizontal lines on the image show the moments when trades should be opened. The red horizontal lines on the chart are the suggested places for stop loss orders.

Give the sell order as soon as the price is reached (discipline).

Instead of looking to buy a low market or sell a high market, it’s far more effective to make use of technical levels in combination with price action signals. This will give you a much better chance of catching a favorable entry. William Delbert Gann, also called WD Gann, was a finance trader who developed a technical trading tool known as Gann angles. Just as impressive as the trading tool he developed are the rules he traded by.

Ruchir Gupta – Creating an Impact through his Stock Market Timing Techniques & Forecasting in the Tradi… – Zee Business

Ruchir Gupta – Creating an Impact through his Stock Market Timing Techniques & Forecasting in the Tradi….

Posted: Thu, 10 Feb 2022 08:00:00 GMT [source]

Liquidity is considered “high” when there is a significant level of trading activity and when there is both high supply and demand for an asset, as it is easier to find a buyer or seller. Hope this example can help some people understand when trading. Next lesson on using Gann angles it consists series of angles that ranged from 1 to 360 degrees. In the up-chart, we have a full cycle which is 360 degrees, i highlighted the main angles with small circles and the sub-angle between every 2 main angles.

Trend Deciding Level: 532

The Gann square of nine gets its name because if you look at the above chart again, the number 9 represents the completion of the first square. He is primarily known for his market forecasting abilities, such as the Gann square of nine which combine a mix of geometry, astrology, and ancient math techniques. Gann started trading at the age of 24 and was a religious man. Considered one of the “titans of technical analysis,” Gann and his Gann Square have gone down in trading history with the likes of Dow, Wyckoff, and others.

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. Altsignals does not offer investment advice and nothing in the calls we make should be construed as investment advice. Altsignals provides information and education based on our own trades. You are paying to follow our trades that we document for educational purposes. With this, we integrate time into our trading strategies, which allows us to improve the overall performance of our systems.

Gann Fan Line Bounces – Whenever the price bounces from a Gann line, you can use this opportunity to open a trade. The same as with the Gann Fan Line Breakouts, after you spot a bounce you should confirm it with an additional candle. These might seem insignificant when it comes to forecasting, but they can be the very things that can define a successful or a bad trade. To use the Gann chart, simply replace the starting number 1 with a number of your choice and the desired step value. In the above example, the increment is 1, but you could use larger or smaller values. The chart below shows the Gann square of nine with the circle plotted around it.

Gann Grid

A year after he started trading in the stock markets, he moved to New York City to work at a Wall Street brokerage firm. He went ahead and created his investment strategy as a broker as he observed the mistakes of clients and learned from them. Most of these were very powerful, that they are widely used by traders even today. His theory on intraday trading is one of the most successful methods for day traders. The following is the very best trading strategy that I believe possible when trading the Forex markets. Forex GANN Trading Strategy is based on the principle, buy low and sell high off the 4hr.

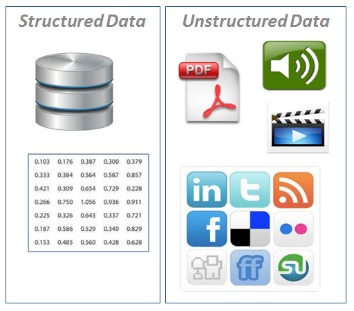

He devoted himself to a deep study of ancient astrology, ancient mathematics, geometry and astronomy. Gann wrote many books on stock trading and gained many supporters of his theory. In this manner, the default Gann trading application suggests that 45 degrees’ trend lines is the most important reference point from which other Gann trading tools should be analyzed. Price and volume are the oldest indicators you will find in the market. As day traders we are always looking for an edge, hence the endless supply of indicators and trading methodologies.

Cory is an expert on stock, forex and futures price action trading strategies. One of the most notable traders in the application of astrology trading, all of Gann’s techniques find their basis in geometry, astronomy and astrology, and ancient mathematics. Uncover more information about stock markets by learning how to see bullish candlestick patterns, and put them to work within your technical analysis…. Learn Forex Trading Pivot points are extremely popular with traders, they are used to spot direction, probable reversal points and potential support and resistance levels.

According to his theory, during a unit of time, the price will improve by one unit of price. In the world of trading, the name of William Delbert Gann is one of the best known. This mathematician, dubbed as a trader famous for his study of cycles, has developed a technical indicator. For insights on currencies and other markets follow the links below to access our sample technical analyses. Gann will help you understand the current volatility in the stock market. Place your protective stop loss below the most recent low, which coincides with the point where you spent your second Gann fan.

After all, what we are really interested in is the direction of the market. To draw the Gann Grid, you need to identify two points that define the size of the cells. If used correctly, the Gann Grid tells the trader where a consolidation will occur. You will learn what are the levels important in Trade and how to earn with the trend.

This goes to show that some of the most simplistic forms of https://traderoom.info/ analysis such as price action are here to stay, just as the most basic rules of trading psychology are timeless. Originating from a financial trend in the 80s’, explore the world of forex trading through bearish candlestick patterns, and what they mean for your markets of choice. The best Gann fan trading strategy is a complex support and resistance trading strategy that uses diagonal support and resistance levels.

- Traders may also use different angles to identify resistance or support.

- The most bullish pair for BTCUSD in Trine was Mercury – Saturn; 80% of all Trines for this pair corresponded to a bullish momentum.

- These angles are superimposed over a price chart to show potential support and resistance levels.

- Among his theories, the square of 9 method is the most popular.

- According to Gann, the price should then drop down to the next trendline (the 2х1 ray).

If you are risking too much capital on a single trade, you’re going to be tempted to close the position too quickly, thus missing out on potential profits. It ebbs and flows according to the news and sentiments that impact it. This is why we, as traders, set profit targets but we don’t set time limits.

In his predicative strategies, Gann used a variety of methods applied in geometry, astronomy, astrology, and ancient mathematics. There is no unanimity among experts on the usefulness and relevance of the techniques developed by Gann. Take a look at what Gann Analysis LLC has to say before you trade your favorite market. To build a Gann fan, you first need to draw a perfect angle of 45 degrees. On the Tradingview platform, you can find the Trend Angle tool in the left side panel.